Rent is usually the largest monthly expense for people living in apartments, so it's no surprise that many people ask the same crucial question before signing a lease: How much of my income should go to rent? Getting your rent-to-income ratio right can mean the difference between feeling financially comfortable and constantly worrying about money.

While there's no one-size-fits-all answer, there are several proven guidelines that can help you find a rent amount that fits your income and lifestyle. Let's explore these methods so you can choose the approach that works best for your financial situation.

The 30% income rule

The most widely recognized guideline suggests spending no more than 30% of your gross monthly income on rent. Gross income is your earnings before taxes and other deductions are taken out.

For example, if you make $3,500 a month before taxes, the 30% rule suggests keeping rent at or below $1,050. This guideline became popular because it's straightforward and easy to apply.

However, the 30% rule has limitations. It doesn't account for varying tax rates, living costs across different cities, or your personal spending habits. While it provides a useful starting point, it may not reflect what truly feels affordable for your situation.

The take-home pay approach

The take-home pay guideline refers to the actual money that hits your bank account after taxes and deductions. This approach typically recommends spending 25% to 35% of your net income on rent.

This method offers a clearer view of affordability, especially if you have high tax rates, significant retirement contributions, or substantial benefit deductions. By using the actual amount you see hit your bank account, you're more likely to leave enough room for savings and daily expenses.

While calculating take-home pay requires an extra step, it provides a more accurate picture of how rent fits into your real monthly cash flow.

Gross income vs. take-home pay: Understanding the difference

One common mistake renters can make is budgeting based on gross income instead of their actual earnings. Taxes, retirement contributions, and benefit deductions can reduce your paycheck by 20 to 30% or more.

For instance, rent that equals 30% of gross income could easily represent 40% or more of your take-home pay.

The 50/30/20 budget

Rather than focusing solely on rent, some renters prefer the comprehensive 50/30/20 budgeting framework, which divides your take-home pay into three clear categories:

- 50% for essential needs (rent, utilities, groceries, transportation)

- 30% for wants and discretionary spending

- 20% for savings and debt repayment

Under this system, rent is just one component of your "needs" category. Depending on your other essential expenses, rent might claim a larger or smaller portion of that 50%. This framework emphasizes overall financial balance rather than hitting a specific rent percentage.

Location-based reality check

In high-cost cities, some renters must adjust their expectations based on local market conditions. This approach compares average rent prices in your target area against typical local incomes.

While this method reflects real-world housing markets, it often results in higher rent percentages than traditional guidelines suggest. Renters using this approach typically compensate by reducing transportation costs (living closer to work) or choosing smaller living spaces.

This strategy works best when paired with careful monthly expense tracking to ensure other costs don't spiral out of control.

Your income stability matters

Your income's predictability should influence how much rent you can comfortably handle. If you have a steady salary, you might feel confident spending toward the higher end of any guideline range.

However, if your income fluctuates — whether you're freelancing, working commission-based jobs, or running a business — consider staying toward the lower end to create a financial buffer for slower months.

This factor doesn't change the math, but it does affect how much financial cushion you may need for peace of mind.

Don't forget the hidden housing costs

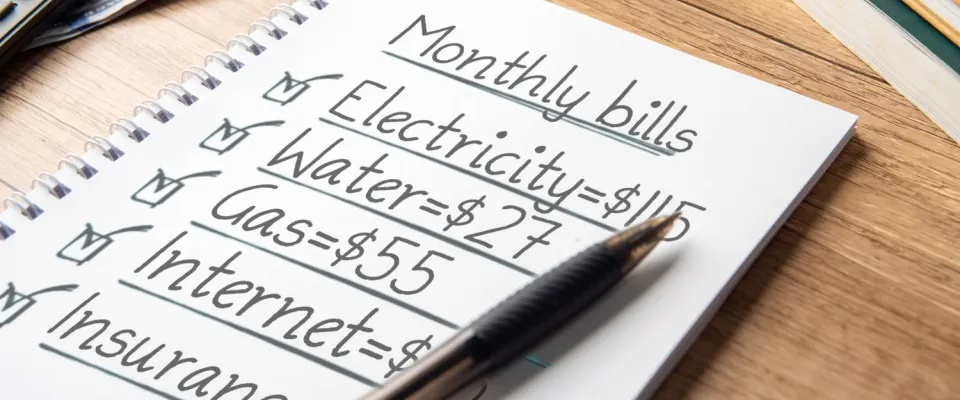

Regardless of which guideline you choose, remember to factor in all housing-related expenses beyond base rent:

- Utilities (electricity, gas, water, internet)

- Parking or storage fees

- Pet deposits and monthly pet rent, if applicable

- Renters insurance

These additional costs can add a few hundred dollars to your monthly housing expenses, significantly affecting what rent amount truly feels affordable.

Comparing your options: Which method fits you?

Each approach offers distinct advantages:

- The 30% rule provides simplicity.

- Take-home pay calculations can reflect your actual spending power.

- The 50/30/20 framework balances rent with other financial priorities.

- Location-based budgeting acknowledges local market realities.

Most successful renters combine elements from multiple methods rather than following just one approach.

Here’s what you can do next:

- Calculate your rent budget using two or three different methods.

- Research actual rental costs in your target neighborhoods.

- Factor in all housing-related expenses beyond base rent.

- Choose a rent amount that aligns with both the guidelines and your comfort level.

- Experiment with different percentages and find what works for you.

Determining how much of your income should go toward rent depends on your unique combination of income, expenses, location, and financial goals. The guidelines above, from the traditional 30% rule to comprehensive budgeting frameworks, offer valuable insights for different situations.

The most effective approach is one that keeps your rent manageable while preserving room for savings, emergency funds, and the lifestyle choices that matter to you.

Key takeaways:

- There is no single rent percentage that works for every renter.

- The 30% guideline is common but may not reflect real take-home pay.

- Budget frameworks like 50/30/20 offer a broader view of affordability.

- Including all housing-related costs helps prevent budget strain.